My post on Gold on why late entry participants could get stop out should their psychology is weak trading very short term like intraday or contra trader and explain why price action matter instead of value approach. Low price creates value so how low price is determining the value by using Technical Analysis to determine value and time entry (Half Theory by Hu Li Yang).

Usually weak psychology traders or investors could get their long positions on SPDR GLD ETF who are late entry participants, stop out with a 10% correction which is too much to bear having a stop loss mentality, SPDR GLD ETF recently price run up to $150 USD price level set a 6 year high not seen since year 2013 with media headlines out pouring creating exuberance in commoditiy Gold. The over exuberance in commodity Gold could translate into a few reasons or factors leading to its price run up. One of them is an increase in tariffs on US China imports on 1st September 2019, Hong Kong unrest over an extradition bill impasse and BREXIT protests arising from 5 weeks parliament suspension, lower of Interest rates by US Fed Reserve Central Bank easing of monetary policy boost demand for commodity Gold as safe haven assets with expectations of inflationary pressure and weakening of US dollar.

Should trade tension between US China ease, gold could see a correction of around 10% to shake out weak psychology traders investors with mathematical equation of using $150 price level recent high X 0.9 (10%) = $135 or $135 X 0.85 (15%) = $127, my preferred entry price level would be between $132 to $137 where the classical neckline resistance turn support illustrate at Chart 2.

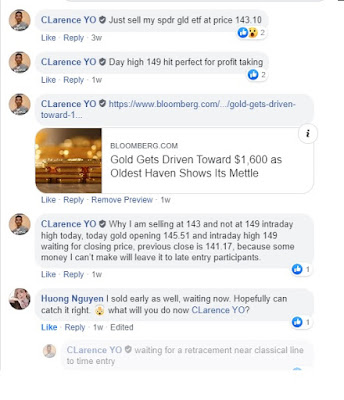

Recently, I had took profits on my long SPDR GLD ETF positions, i feel there is something worth to write and educate why some money are better left for the late entry participants to make which one trader has to forego due to increase violatility.

Gold Historical Charts With Technical Analysis - Chart 1

Gold Historical Charts With Technical Analysis - Chart 2

My Trade Summary

https://www.scmp.com/news/china/diplomacy/article/3024186/trump-raises-tariffs-us250-billion-chinese-imports-30-cent-25?fbclid=IwAR0raS7PymXi2YP8-9z62j4d4JHrP7asQbRuyA7CQsxHYIfRBGw5adTWhnI

https://www.bloomberg.com/news/articles/2019-08-27/central-bankers-new-found-love-of-gold-seen-bolstering-demand

https://www.scmp.com/economy/china-economy/article/3023615/are-hong-kongs-protests-crushing-citys-role-chinas-greater?fbclid=IwAR28GzJg_y7kWdUOh-RqeRCUCHEZWkdqjjpIWDYEtmboHHyLItFjLAjy8Hg

https://www.bloomberg.com/news/articles/2019-08-26/gold-gets-driven-toward-1-600-as-oldest-haven-shows-its-mettle?fbclid=IwAR30w2L4pFiTJ5uiNbB3BMcshdj5VxB3xSwRncbDz8Nj9qkTQuKbExGq21o

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Nice work this blog gives clear knowledge about investment. stockinvestor.in is a stock related website which provides all stock market information.

ReplyDeleteinvestment account

current market price

investment strategy