I would like to share on which you are probably aware of a Voice Translator Device able to voice translate from A language to B langauge instantly.

The voice translator device is useful for business meeting presentation and Travellers who are unable to communicate with the natives.

Instead of buying a voice translator device which would cost at least USD $200 bucks for a device bought online, you could actually download an app called Google Translate to perform voice translation instantly, you dont have to pay any fees to perform instantly voice translation with ever changing technological advancement to improve our lives.

I am afraid that with the technology disruption, more businesses are under pressure especially so where the manufacturer of the voice translator device could see declining sales volume, trainers who are teaching particular popular language like Japanese, Korean, Italian, German and French language could see less participation.

I will show you how to voice translate from an English language to Japanese language without the need to purchase a voice translator device, you can do it free via your smart phone as simple as that, albeit the speed of translating is probably slower than the voice translator device.

Please click on my youtube video link to watch and remember to like and subscribe my video for future updates probably on global financial market outllook or sharing on how to leverage on technology without the need to spend your prceious dollars and cents.

Thank you for your support.

Please click on my youtube video channel link below to watch

https://youtu.be/0s-yNdbbCEs

Youtube link below is the how voice translator device operate.

https://youtu.be/Sx8h8rywRhI

https://youtu.be/MIPIMLZsuKU

https://youtu.be/sBQ6oWe-ACc

Sunday, 15 September 2019

Tuesday, 10 September 2019

SPDR GLD ETF

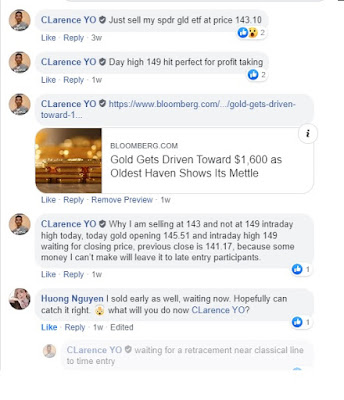

This is my second post on Gold update on its recent move which i had taken my profits waiting for a retracement for further upside to retest Gold all time high at $1906 set in year September 2011.

My post on Gold on why late entry participants could get stop out should their psychology is weak trading very short term like intraday or contra trader and explain why price action matter instead of value approach. Low price creates value so how low price is determining the value by using Technical Analysis to determine value and time entry (Half Theory by Hu Li Yang).

Usually weak psychology traders or investors could get their long positions on SPDR GLD ETF who are late entry participants, stop out with a 10% correction which is too much to bear having a stop loss mentality, SPDR GLD ETF recently price run up to $150 USD price level set a 6 year high not seen since year 2013 with media headlines out pouring creating exuberance in commoditiy Gold. The over exuberance in commodity Gold could translate into a few reasons or factors leading to its price run up. One of them is an increase in tariffs on US China imports on 1st September 2019, Hong Kong unrest over an extradition bill impasse and BREXIT protests arising from 5 weeks parliament suspension, lower of Interest rates by US Fed Reserve Central Bank easing of monetary policy boost demand for commodity Gold as safe haven assets with expectations of inflationary pressure and weakening of US dollar.

Should trade tension between US China ease, gold could see a correction of around 10% to shake out weak psychology traders investors with mathematical equation of using $150 price level recent high X 0.9 (10%) = $135 or $135 X 0.85 (15%) = $127, my preferred entry price level would be between $132 to $137 where the classical neckline resistance turn support illustrate at Chart 2.

Recently, I had took profits on my long SPDR GLD ETF positions, i feel there is something worth to write and educate why some money are better left for the late entry participants to make which one trader has to forego due to increase violatility.

Gold Historical Charts With Technical Analysis - Chart 1

Gold Historical Charts With Technical Analysis - Chart 2

My Trade Summary

https://www.scmp.com/news/china/diplomacy/article/3024186/trump-raises-tariffs-us250-billion-chinese-imports-30-cent-25?fbclid=IwAR0raS7PymXi2YP8-9z62j4d4JHrP7asQbRuyA7CQsxHYIfRBGw5adTWhnI

https://www.bloomberg.com/news/articles/2019-08-27/central-bankers-new-found-love-of-gold-seen-bolstering-demand

https://www.scmp.com/economy/china-economy/article/3023615/are-hong-kongs-protests-crushing-citys-role-chinas-greater?fbclid=IwAR28GzJg_y7kWdUOh-RqeRCUCHEZWkdqjjpIWDYEtmboHHyLItFjLAjy8Hg

https://www.bloomberg.com/news/articles/2019-08-26/gold-gets-driven-toward-1-600-as-oldest-haven-shows-its-mettle?fbclid=IwAR30w2L4pFiTJ5uiNbB3BMcshdj5VxB3xSwRncbDz8Nj9qkTQuKbExGq21o

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

My post on Gold on why late entry participants could get stop out should their psychology is weak trading very short term like intraday or contra trader and explain why price action matter instead of value approach. Low price creates value so how low price is determining the value by using Technical Analysis to determine value and time entry (Half Theory by Hu Li Yang).

Usually weak psychology traders or investors could get their long positions on SPDR GLD ETF who are late entry participants, stop out with a 10% correction which is too much to bear having a stop loss mentality, SPDR GLD ETF recently price run up to $150 USD price level set a 6 year high not seen since year 2013 with media headlines out pouring creating exuberance in commoditiy Gold. The over exuberance in commodity Gold could translate into a few reasons or factors leading to its price run up. One of them is an increase in tariffs on US China imports on 1st September 2019, Hong Kong unrest over an extradition bill impasse and BREXIT protests arising from 5 weeks parliament suspension, lower of Interest rates by US Fed Reserve Central Bank easing of monetary policy boost demand for commodity Gold as safe haven assets with expectations of inflationary pressure and weakening of US dollar.

Should trade tension between US China ease, gold could see a correction of around 10% to shake out weak psychology traders investors with mathematical equation of using $150 price level recent high X 0.9 (10%) = $135 or $135 X 0.85 (15%) = $127, my preferred entry price level would be between $132 to $137 where the classical neckline resistance turn support illustrate at Chart 2.

Recently, I had took profits on my long SPDR GLD ETF positions, i feel there is something worth to write and educate why some money are better left for the late entry participants to make which one trader has to forego due to increase violatility.

Gold Historical Charts With Technical Analysis - Chart 1

Gold Historical Charts With Technical Analysis - Chart 2

My Trade Summary

https://www.scmp.com/news/china/diplomacy/article/3024186/trump-raises-tariffs-us250-billion-chinese-imports-30-cent-25?fbclid=IwAR0raS7PymXi2YP8-9z62j4d4JHrP7asQbRuyA7CQsxHYIfRBGw5adTWhnI

https://www.bloomberg.com/news/articles/2019-08-27/central-bankers-new-found-love-of-gold-seen-bolstering-demand

https://www.scmp.com/economy/china-economy/article/3023615/are-hong-kongs-protests-crushing-citys-role-chinas-greater?fbclid=IwAR28GzJg_y7kWdUOh-RqeRCUCHEZWkdqjjpIWDYEtmboHHyLItFjLAjy8Hg

https://www.bloomberg.com/news/articles/2019-08-26/gold-gets-driven-toward-1-600-as-oldest-haven-shows-its-mettle?fbclid=IwAR30w2L4pFiTJ5uiNbB3BMcshdj5VxB3xSwRncbDz8Nj9qkTQuKbExGq21o

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Thursday, 20 June 2019

Indofood Agri (SGX:5JS)

Disclaimer: I have long positions in Indofood Agri (SGX:5JS), this is not a recommedation to buy, illustrated for education purpose to share with the members of the public mostly misinformed retail investors comprising in the marketplace, I am also a small retail investor but specialise in fund flow analysis.

As an investor of Indofood Agri Ltd, i am surprised and disappointed by the voluntarily conditional takeover offer by Salim Group, tycoon of Indonesia of Indomie, because the takeover price is too low at SGD $0.28 (first offer) and $0.3275 (latest second offer), objective for their takeover understood is to delist and privatise Indofood Agri Ltd. Indofood Agri Ltd also emphasize on remaining cautious on its earnings momentum and its ability to return to pre 2017 earnings level although share price performance and valuations were undemanding.

So Indofood Agri Ltd Directors recommend retail investor to accept the offer unless they are able to obtain a higher valuation price than the offer price on the open market after accounting for brokerage and related costs. IFA quote the offer price not fair but reasonable.

The timing for takeover to delist Indofood Agri comes at the backdrop of global economy currently undergoing an expansion phase where the bull run is likely to continue for another few years to go. If Salim Group decide to force the takeover deal through, as an small retail investor, i have no control of but to accept the fate, when it comes to any future investment decision of mine to invest in any particular company, i would avoid Salim Group and its subsidiary as the major shareholder of any public listed company because retail investors are mostly value investor that stays loyal to the public listed company in good times and in bad times in any capital fund raising activity, and they are deprived of any growth opportunities of staying loyal to the public listed company. I really hope Salim Group can reconsider the delisting option, maintain listing in SGX so that investors can participate in the growth potential for Indfood Agri Ltd.

https://www.businesstimes.com.sg/companies-markets/indomie-maker%E2%80%99s-buyout-offer-for-indofood-agri-%E2%80%98not-fair-but-reasonable%E2%80%99-says-ifa

I observed Indofood Agri Ltd to be a slightly high beta stock, obtain the data source from Yahoo Finance, its reading is 1.30X in Beta as compare to market average of 1.0X as the benchmark as explained by Stockopedia.

High Beta stock theoretically tend to be violatile in nature hence riskier but it provide the potential for higher returns through higher returns.

As explained by Investopedia, Beta's definition is a reading of that is greater than 1.0 indicates that the security's price is theorectically more violatile than the market. For example, if a stock's beta is 1.20, it is assumed to be 20% more violatile than the market.

https://sg.finance.yahoo.com/quote/5JS.SI/

https://www.dbs.com.sg/treasures/aics/templatedata/article/equity/data/en/DBSV/012014/IFAR_SP.xml

https://www.stockopedia.com/ratios/beta-stock-5114/

https://www.investopedia.com/terms/b/beta.asp

So let's take a look at the Chart of Indofood Agri Ltd

Monthly Timeframe

Technical Analysis Part 1

Based on above chart although price is oscilliate in a downtrend movement but it had broke out of downtrending line resistance. An inverted fan is illustrated act as a resistance and support line touching all the peaks and troughs.

Applying technical analysis to determine overvalue, fair value and undervalue, there is an approach taught by Asian Investment Guru, Mr. Hu Li Yang, on his halving valuation method simply take the peak price as the range of overvalue, peak price divde by 2 halving method gives your fair value and further reduction of halving gives you undervalue region.

Indofood Agri Ltd all time high price of 2.93 in year 2007 applying halving valuation method would see fair value range at 1.465 and undervalue value range at 0.73 below price level. Hence it is considered that the takeover price of S$0.3275 price is at the extremely undervalue range but a premium considered at the all time low price of S$0.181 in year 2019.

Technical Analysis Part 2

Above Chart pattern suggest price channel movement upper orange color lines, median green color line and lower orange color lines drawn, so price is anticipated to reach the upper orange color lines connecting all the peaks as resistance and lower orange color lines connecting all the troughs as support.

There is a falling wedge pattern observed as the bullish chart pattern.

Fundamental on Maecro Outlook of Palm Oil

Indonesia is the largest producer of Palm Oil with Malaysia the second largest producer.

There are positive reports on the demand for Palm Oil, where the demand for Palm Oil is influence by the strength of US dollar, where ususally commodities is priced in USD for trade settlement. The stronger US Dollar has developed an inverse relationship to the demand of the commodities in particular. USD strength result in lower demand for commodities and weaker USD result in higher demand for commodities.

Based on Fund Flow USD (DXY) spot index has reach its peak hence more downward price pressure is anticipated hence boosting demand for commodities and other currencies. USD is pegged to quite a few asian currencies like Hong Kong Dollar (HKD) and Chinese Yuan (CNH), weaker USD suggest strengthening of Chinese Yuan (CNH) weakening Hong Kong Dollar (HKD).

https://www.hellenicshippingnews.com/bumper-year-ahead-for-palm-oil-imports-in-china/

https://www.ofimagazine.com/news/palm-oil-based-biodiesel-exports-to-china-and-eu-surge-in-first-quarter-201

https://www.thestar.com.my/business/business-news/2018/12/21/chinas-palm-fuel-imports-soar-to-record/

SWOT Analysis (Micro on Palm Oil Sector)

Below article by David Dodwell on his opinion on future demand of Palm Oil is worth a read highlighting the environmental concerns affecting the demand of Palm Oil.

"Outside In by David Dodwell

https://www.scmp.com/comment/insight-opinion/article/3010629/palm-oil-industry-going-smoke-market-forces-and

Fund Flow Analysis

Smart monies are long bias in Palm Oil Futures, with swap dealers and large speculators seen reducing and accumulating.

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

As an investor of Indofood Agri Ltd, i am surprised and disappointed by the voluntarily conditional takeover offer by Salim Group, tycoon of Indonesia of Indomie, because the takeover price is too low at SGD $0.28 (first offer) and $0.3275 (latest second offer), objective for their takeover understood is to delist and privatise Indofood Agri Ltd. Indofood Agri Ltd also emphasize on remaining cautious on its earnings momentum and its ability to return to pre 2017 earnings level although share price performance and valuations were undemanding.

So Indofood Agri Ltd Directors recommend retail investor to accept the offer unless they are able to obtain a higher valuation price than the offer price on the open market after accounting for brokerage and related costs. IFA quote the offer price not fair but reasonable.

The timing for takeover to delist Indofood Agri comes at the backdrop of global economy currently undergoing an expansion phase where the bull run is likely to continue for another few years to go. If Salim Group decide to force the takeover deal through, as an small retail investor, i have no control of but to accept the fate, when it comes to any future investment decision of mine to invest in any particular company, i would avoid Salim Group and its subsidiary as the major shareholder of any public listed company because retail investors are mostly value investor that stays loyal to the public listed company in good times and in bad times in any capital fund raising activity, and they are deprived of any growth opportunities of staying loyal to the public listed company. I really hope Salim Group can reconsider the delisting option, maintain listing in SGX so that investors can participate in the growth potential for Indfood Agri Ltd.

https://www.businesstimes.com.sg/companies-markets/indomie-maker%E2%80%99s-buyout-offer-for-indofood-agri-%E2%80%98not-fair-but-reasonable%E2%80%99-says-ifa

I observed Indofood Agri Ltd to be a slightly high beta stock, obtain the data source from Yahoo Finance, its reading is 1.30X in Beta as compare to market average of 1.0X as the benchmark as explained by Stockopedia.

High Beta stock theoretically tend to be violatile in nature hence riskier but it provide the potential for higher returns through higher returns.

As explained by Investopedia, Beta's definition is a reading of that is greater than 1.0 indicates that the security's price is theorectically more violatile than the market. For example, if a stock's beta is 1.20, it is assumed to be 20% more violatile than the market.

https://sg.finance.yahoo.com/quote/5JS.SI/

https://www.dbs.com.sg/treasures/aics/templatedata/article/equity/data/en/DBSV/012014/IFAR_SP.xml

https://www.stockopedia.com/ratios/beta-stock-5114/

https://www.investopedia.com/terms/b/beta.asp

So let's take a look at the Chart of Indofood Agri Ltd

Monthly Timeframe

Technical Analysis Part 1

Based on above chart although price is oscilliate in a downtrend movement but it had broke out of downtrending line resistance. An inverted fan is illustrated act as a resistance and support line touching all the peaks and troughs.

Applying technical analysis to determine overvalue, fair value and undervalue, there is an approach taught by Asian Investment Guru, Mr. Hu Li Yang, on his halving valuation method simply take the peak price as the range of overvalue, peak price divde by 2 halving method gives your fair value and further reduction of halving gives you undervalue region.

Indofood Agri Ltd all time high price of 2.93 in year 2007 applying halving valuation method would see fair value range at 1.465 and undervalue value range at 0.73 below price level. Hence it is considered that the takeover price of S$0.3275 price is at the extremely undervalue range but a premium considered at the all time low price of S$0.181 in year 2019.

Technical Analysis Part 2

Above Chart pattern suggest price channel movement upper orange color lines, median green color line and lower orange color lines drawn, so price is anticipated to reach the upper orange color lines connecting all the peaks as resistance and lower orange color lines connecting all the troughs as support.

There is a falling wedge pattern observed as the bullish chart pattern.

Fundamental on Maecro Outlook of Palm Oil

Indonesia is the largest producer of Palm Oil with Malaysia the second largest producer.

There are positive reports on the demand for Palm Oil, where the demand for Palm Oil is influence by the strength of US dollar, where ususally commodities is priced in USD for trade settlement. The stronger US Dollar has developed an inverse relationship to the demand of the commodities in particular. USD strength result in lower demand for commodities and weaker USD result in higher demand for commodities.

Based on Fund Flow USD (DXY) spot index has reach its peak hence more downward price pressure is anticipated hence boosting demand for commodities and other currencies. USD is pegged to quite a few asian currencies like Hong Kong Dollar (HKD) and Chinese Yuan (CNH), weaker USD suggest strengthening of Chinese Yuan (CNH) weakening Hong Kong Dollar (HKD).

https://www.hellenicshippingnews.com/bumper-year-ahead-for-palm-oil-imports-in-china/

https://www.ofimagazine.com/news/palm-oil-based-biodiesel-exports-to-china-and-eu-surge-in-first-quarter-201

https://www.thestar.com.my/business/business-news/2018/12/21/chinas-palm-fuel-imports-soar-to-record/

SWOT Analysis (Micro on Palm Oil Sector)

Below article by David Dodwell on his opinion on future demand of Palm Oil is worth a read highlighting the environmental concerns affecting the demand of Palm Oil.

"Outside In by David Dodwell

Is the palm oil industry going up in smoke as market forces and environmental concerns collide?

- Malaysia and Indonesia are grappling with an impending European Union ban on palm oil in biofuel combined with uncertain demand from the food industry, declining global oil prices and questions about the credibility of ‘sustainable’ plantations"

Fund Flow Analysis

Smart monies are long bias in Palm Oil Futures, with swap dealers and large speculators seen reducing and accumulating.

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Tuesday, 4 June 2019

KLCI Index Chart Analysis

Malaysia KLCI Index Analysis

I would like to touch on the outlook of the Malaysia KLCI index market after much cross examine and cross asset class analysis, that conclusion is KLCI is still bullish based on the principle of Fundamental Analysis, Technical Analysis and Fund Flow Analysis perspective.

Fundamental Analysis

Malaysia's economy is mainly export driven where it exports semiconductor & electronic products, palm oil, liquefied natural gas, petroleum, chemicals, machinery, vehicles, optical & scientific equipment, metals, rubber and woods at a value of 263 Billion in revenue, most to countries in descending order like China (16%), Singapore (14%), USA (13%), Japan (6.7%), Hong Kong (5.2%) and Thailand (4.1%).

please refer to the below link for more information.

https://en.wikipedia.org/wiki/Economy_of_Malaysia

Next we look at Trading Economics for Malaysia Economic Indicators, it is observed that USDMYR is currently trading at 4.18 level weaker than expected, recent high for USDMYR is 4.20 in November 2018. weaker currency boost exports couple with the fact that Malaysia Central Bank just cut interest rate from 3.25% to 3% in May 2019, a signals to boost economic activity through lower montary policy making to achieve higher exports objective. As an investor based on the fact that Malaysia Central Bank cut interest rate, investor could take a look at resource based sector and financial sector to position and include in their portfolio. resource based sector could see more exports and financial sector could see an increase in business lending activity. A weakening currency will result in an immense inflationary pressure felt by the Malaysians hence dampening more consumption. It is not surprising to see GDP growth rate fell slightly probably due to and influence by maecro economic conditions of Trade War impact between USA and China. A weakening currency tend to boost tourism activity in Malaysia to Genting Highlands Casino.

Current Palm oil price is traded at 2069 RM at 31 May 2019.

Please refer to the below link for updated daily Palm Oil settlement price

http://www.mpoc.org.my/Daily_Palm_Oil_Prices.aspx

Technical Analysis

Asian Investment Guru Mr. Hu Li Yang once said that stock market is the window to economic growth and not vice versa, a booming stock market where investors made profits from tend to boost demand consumption in real economy, a faltering stock market would not be able to boost demand consumption. So lets take a look at Technical Charts of Bursa (1818)

Monthly Chart Historical

Monthly Chart Historical With Technical Analysis

Charts of Bursa is bullish with big ascending triangle chart formation seen using orange color and green color lines drawn. a profitable stock market signals investor are investing in Malaysia stock markets.if KLCI rise every investor makes profit hence would translate into capital expenditure spending. Price is observed to oscilliate between green color upper and lower lines known as price channel formation. Investor could consider to buy on dips touching lower green color lines as support. Price just broke November 2007 high of 7.425 and register all time high in May 2018 with 7.844 price level when global economies are in a rough patch resulting in USA and China Trade War tension. Price is expected to challenge 10 RM psychology level for Bursa (1818) and subsequently challenge 13 RM with simple mathematics formula using year 2007 high 7.42 - year 2009 low 1.91 = 5.51 difference in price + 7.42 year 2007 high with aprice target of 12.93.

Dow Jones Malaysia Stock Index Monthly Chart

Dow Jones Malaysia Stock Index Monthly Chart with Technical Analysis

Dow Jones Malaysia Stock Index is observed to be bullish with various bullish chart formation displayed

1) Upper and Lower Orange Green color lines drawn - Price Channel

2) Price Channel, Rectangle and Bull Pennant.

3) Ascending Triangle Chart Formation with an upside price target of 444 and 509 points respectively using simple mathematic formula year 2008 high of 295 - year 2009 low of 146 = difference of 149 points + year 2008 high 295 = 444 points first target and using year 2014 high 360 points - year 2009 low 146 = diffference of 214 points + year 2008 high 295 points = 509 points as second target.

Ishares MSCI Malaysia ETF Monthly Chart

Ishares MSCI Malaysia ETF Monthly Chart with Technical Analysis

Ishares MSCI Malaysia ETF is observed to be bullish with various bullish chart formation displayed

1) Upper and Lower Green color lines drawn - Price Channel

2) Price Channel, Rectangle and Bull Pennant.

3) Ascending Triangle Chart Formation with an upside price target of 55 to 56.

KLCI Index Monthly Histroical Chart Yahoo Finance

KLCI Index Monthly Histroical Chart Yahoo Finance with Technical Analysis

KLCI is observed to be bullish with various bullish chart formation displayed

1) Dark Blue Color lines drawn - Falling Wedge Chart Formation

2) Upper and Lower Light Blue color lines drawn - Price Channel

3) Orange color lines drawn - Price Channel, Rectangle and Bull Pennant.

4) Ascending Triangle Chart Formation with an upside points target of 2450 points or possibly 3000 psychology resistance points target for secular bull market.

Fund Flow Analysis

Smart monies are bullish bias having accumulate large position of long futures.

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

I would like to touch on the outlook of the Malaysia KLCI index market after much cross examine and cross asset class analysis, that conclusion is KLCI is still bullish based on the principle of Fundamental Analysis, Technical Analysis and Fund Flow Analysis perspective.

Fundamental Analysis

Malaysia's economy is mainly export driven where it exports semiconductor & electronic products, palm oil, liquefied natural gas, petroleum, chemicals, machinery, vehicles, optical & scientific equipment, metals, rubber and woods at a value of 263 Billion in revenue, most to countries in descending order like China (16%), Singapore (14%), USA (13%), Japan (6.7%), Hong Kong (5.2%) and Thailand (4.1%).

please refer to the below link for more information.

https://en.wikipedia.org/wiki/Economy_of_Malaysia

Next we look at Trading Economics for Malaysia Economic Indicators, it is observed that USDMYR is currently trading at 4.18 level weaker than expected, recent high for USDMYR is 4.20 in November 2018. weaker currency boost exports couple with the fact that Malaysia Central Bank just cut interest rate from 3.25% to 3% in May 2019, a signals to boost economic activity through lower montary policy making to achieve higher exports objective. As an investor based on the fact that Malaysia Central Bank cut interest rate, investor could take a look at resource based sector and financial sector to position and include in their portfolio. resource based sector could see more exports and financial sector could see an increase in business lending activity. A weakening currency will result in an immense inflationary pressure felt by the Malaysians hence dampening more consumption. It is not surprising to see GDP growth rate fell slightly probably due to and influence by maecro economic conditions of Trade War impact between USA and China. A weakening currency tend to boost tourism activity in Malaysia to Genting Highlands Casino.

Current Palm oil price is traded at 2069 RM at 31 May 2019.

Please refer to the below link for updated daily Palm Oil settlement price

http://www.mpoc.org.my/Daily_Palm_Oil_Prices.aspx

Technical Analysis

Asian Investment Guru Mr. Hu Li Yang once said that stock market is the window to economic growth and not vice versa, a booming stock market where investors made profits from tend to boost demand consumption in real economy, a faltering stock market would not be able to boost demand consumption. So lets take a look at Technical Charts of Bursa (1818)

Monthly Chart Historical

Monthly Chart Historical With Technical Analysis

Charts of Bursa is bullish with big ascending triangle chart formation seen using orange color and green color lines drawn. a profitable stock market signals investor are investing in Malaysia stock markets.if KLCI rise every investor makes profit hence would translate into capital expenditure spending. Price is observed to oscilliate between green color upper and lower lines known as price channel formation. Investor could consider to buy on dips touching lower green color lines as support. Price just broke November 2007 high of 7.425 and register all time high in May 2018 with 7.844 price level when global economies are in a rough patch resulting in USA and China Trade War tension. Price is expected to challenge 10 RM psychology level for Bursa (1818) and subsequently challenge 13 RM with simple mathematics formula using year 2007 high 7.42 - year 2009 low 1.91 = 5.51 difference in price + 7.42 year 2007 high with aprice target of 12.93.

Dow Jones Malaysia Stock Index Monthly Chart

Dow Jones Malaysia Stock Index Monthly Chart with Technical Analysis

Dow Jones Malaysia Stock Index is observed to be bullish with various bullish chart formation displayed

1) Upper and Lower Orange Green color lines drawn - Price Channel

2) Price Channel, Rectangle and Bull Pennant.

3) Ascending Triangle Chart Formation with an upside price target of 444 and 509 points respectively using simple mathematic formula year 2008 high of 295 - year 2009 low of 146 = difference of 149 points + year 2008 high 295 = 444 points first target and using year 2014 high 360 points - year 2009 low 146 = diffference of 214 points + year 2008 high 295 points = 509 points as second target.

Ishares MSCI Malaysia ETF Monthly Chart

Ishares MSCI Malaysia ETF Monthly Chart with Technical Analysis

Ishares MSCI Malaysia ETF is observed to be bullish with various bullish chart formation displayed

1) Upper and Lower Green color lines drawn - Price Channel

2) Price Channel, Rectangle and Bull Pennant.

3) Ascending Triangle Chart Formation with an upside price target of 55 to 56.

KLCI Index Monthly Histroical Chart Yahoo Finance

KLCI Index Monthly Histroical Chart Yahoo Finance with Technical Analysis

KLCI is observed to be bullish with various bullish chart formation displayed

1) Dark Blue Color lines drawn - Falling Wedge Chart Formation

2) Upper and Lower Light Blue color lines drawn - Price Channel

3) Orange color lines drawn - Price Channel, Rectangle and Bull Pennant.

4) Ascending Triangle Chart Formation with an upside points target of 2450 points or possibly 3000 psychology resistance points target for secular bull market.

Fund Flow Analysis

Smart monies are bullish bias having accumulate large position of long futures.

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Wednesday, 10 April 2019

China Cosco Shipping Holdings Limited (601919)

I feel that there is something worth to write on this educational text book application on technical analysis on A share China Cosco (601919), one of the trade i have taken profit taking for the past few days approaching my target price set.

I would like to touch on 3 points namely, Fundamental Analysis (FA), Technical Analysis (TA) and Fund Flow Analysis (FFA)

On October 2018, China Cosco (601919) reach recent low of 3.33 by using that as a benchmark couple with resistance classical line drawn the immediate resistance is at 6.66 (100%) simple mathematical formula and an useful strategy by Technical Analysis expert Mr. Hu Li Yang's rise by one fold meet resistance pressure 涨一倍埋压. Note that all time low price is 2.73 by using rise by one fold meet resistanc pressure strategy price works out to be 5.46 (CNY) may see resistance turn support and support turn resistance vice versa. if price 5.46 maetrialise after China Cosco recent high of price 6.58 reach past few days x .85% (safety of discount margin) it works out to be 5.59 not far from 5.46 price. Ideally investors can accumulate around price range of 5.26 to 5.59 ranging from (15% to 20% safety of discount margin).

China Cosco A Share (601919) 3 Year Daily Chart

China Cosco A Share (601919) 3 Year Daily Chart With Technical Analysis

Based on this chart, it is observed that classical neckline in upper light blue color hit 3 times and resisted at price 6.56, since price from recent low 3.33 rallied to 6.58 past few days high had seen almost 100% in profit, base on the assumption that price upon reaching 6.56 high from 3.33 low will there be any more horsepower for more upward thrust to break above resistance or price could see a temporary correction to the yellow rectangle line box for consolidation and camping near resistance for more upward price movement. It is notice that the impulsive wave has established from the bottom of yellow rectangle line box to reach 6.56 classical neckline drawn is not sustainable. I would preferred to see a price correction to around 15% to 20% to form a potential inverted head and shoulder chart pattern to time entry again. the next resistance could be 8.52 in sight.

China Cosco A Share (601919) Historical Chart

I would like to touch on 3 points namely, Fundamental Analysis (FA), Technical Analysis (TA) and Fund Flow Analysis (FFA)

Number 1 Point: on Fundamental Analysis, the reason why i decided to take a position on A share China Cosco is because it is a global shipping company where its presence is increasingly felt in the global stage. Baltic Dry Index reach at all time low of 291 points in year 2016 February 12th, where overcapacity in commodities seen its price slump affecting global trade activities follow with credit tightening is at the highest in year 2006 June with 5.255% that cause the financial crisis in year 2007 to 2009.

In the past China Cosco Shipping Holdings being a state owned enterprise of China had seen major corruption scandal that seen its value wiping off in the stock market. The worst is over for China Cosco currently trading in undervalue price. All time high for China Cosco (601919) had seen its share price at 60 (CNY) 60.35 in year 2007 October 19 pre financial crisis 2007-2009. The lowest price reach is 2.73 (CNY) in year 2013 August 2nd.

However ray of hope is shining on China Cosco (601919) and its fortune may overturn soon with the prospect of Baltic Dry Index bottoming in year 2016 with 291 points, had seen index points rallied to 1773 points in year 2018 August 3rd recent high, that is a whopping of 509% before trade war tension between US and China escalate further had caused BDI to drop to its recent low of 601 points in year 2019 February 8th.

For more detail reading up on Baltic Dry Index (BDI) which i wrote earlier please refer to the link http://contrariantraderinvestor.blogspot.com/2017/09/baltic-dry-index-bdi-chart-analysis.html

Number 2 Point: on Technical Analysis, refer to my chart attached source from Chartnexus

China Cosco A Share (601919) 3 Year Daily Chart

On October 2018, China Cosco (601919) reach recent low of 3.33 by using that as a benchmark couple with resistance classical line drawn the immediate resistance is at 6.66 (100%) simple mathematical formula and an useful strategy by Technical Analysis expert Mr. Hu Li Yang's rise by one fold meet resistance pressure 涨一倍埋压. Note that all time low price is 2.73 by using rise by one fold meet resistanc pressure strategy price works out to be 5.46 (CNY) may see resistance turn support and support turn resistance vice versa. if price 5.46 maetrialise after China Cosco recent high of price 6.58 reach past few days x .85% (safety of discount margin) it works out to be 5.59 not far from 5.46 price. Ideally investors can accumulate around price range of 5.26 to 5.59 ranging from (15% to 20% safety of discount margin).

China Cosco A Share (601919) 3 Year Daily Chart

China Cosco A Share (601919) 3 Year Daily Chart With Technical Analysis

China Cosco A Share (601919) Historical Chart

Above is the monthly historical chart with Technical Analysis illustrated.

Number 3 Point: Fund Flow Analysis is observed to be bullish because of more foreign capital inflows into China with MSCI A share inclusion, CNY drawn into IMF Special Drawing Rights (SDR),

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Sunday, 10 March 2019

US Dollar Chart Analysis - Part 2

US Dollar recent strength is a real Bullish Chart formation or fake bullish chart formation as what President Trump had claimed a gentleman in the Federal Reserve Central Bank, loves a stronger dollar, who had engineered a rally in US dollar.

US dollar had broke out of symmetric triangle (bullish chart formation) but fund flow practisioner knew US dollar is executing a false breakout, awaiting for more downside pressure for the US dollar especially President Trump who loves a weaker US Dollar, keep emphasizing on the US dollar strength.

The crucial red support line (support turn resistance) and blue resistance line (resistance turn support) is a strategy used to entry and exit near resistance or support, a line drawn with simple mathematical formula, using the peak + trough / 2 equation, an useful indicator taught by Asian Investment Guru Mr. Hu Li Yang in one of his Youtube videos.

What is observed an imaginery line swing trade setup (downside pressure) is in the making,

Alot of trader particularly employed only certain Fundamental Analysis (FA), Technical Analysis (TA) or both FATA but without considering the critical Fund Flow Analysis aspect, whose trade taken had been stop out by the market makers making them lose money most of the time.

What is fundamental analysis? Fundamental Analysis is not financial ratios used to determine value in equities but in Forex terms, US Dollar itself is a fundamental analysis because US Dollar is the current world reserve currency where major central banks globally held most of their reserves in US Dollar. foreign exchange currency pair like USDSGD, EURUSD for instance are having inverse relationship with the US Dollar, Should US dollar strengthen SGD and Euro will weaken while US dollar weaken, SGD and Euro will strengthen. Also strength and weakness of the currency pair should take into considerations of both Federal Reserve and Monetary Authority of Singapore (central Bank) or European Central Bank (ECB) monetary policy decision that could influence the performance of foreign exchange currency pair. For example, Should ECB embark on a tightening monetary policy cycle, Euro would strengthen against the US dollar. Inter-market analysis is also consider an important fundamental analysis to determine the maecroeconomic environment.

What is Technical Analysis? Technical Analysis is about analyzing chart with price action setup either with a bullish or bearish chart formation or pattern to determine the price target. Chartist also analyse the sentiment given on a particular securities observing volume of the trading transaction whether should they take position in an euphoric or fearful market environment.

Fund Flow analysis is about measuring the capital inflow or outflows of a particular maecroeconomic environment.

Hence can we just apply Technical Analysis (TA) alone? answer is no, we need to combine FA, TA and FFA like what technical analysis expert Mr. Donovan Ang had said.

US Dollar Index - 8 March 2019 with Technical Analysis

US Dollar index - 8 March 2019 with Technical Analysis

US Dollar Index - 8.3.19 without Technical Analysis

US Dollar Index - 8.3.19 with Technical Analysis

US Dollar Index - 8.3.19 without Technical Analysis

US Dollar Index - 8.3.19 with Technical Analysis

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Wednesday, 30 January 2019

Commodities Soybean Technical Analysis

Commodity Soybean has see steep price decline ever since year 2012 reach all time high of 1800 (estimated) in June 2012.

Recently there is a negative new that cause bearish, gloom and doom sentiment that hit commodity soybean pretty much is the Trade War Tensions between United States and China in year 2018.

To counter or retailate US trade war additional tariffs imposed on China, China asked its farmers to grow more soybeans amid trade fights with US.

https://www.npr.org/2018/06/19/621448109/china-tells-farmers-to-grow-more-soybeans-amid-trade-fight-with-u-s

Soybean - Teucrium Soybean Fund ETF has seen price bottoming at price level 15.26 in September 2018 where Trade Tensions ran high with each United States and China both imposing an additional trade tariffs targetting at each other.

However, currently market sentiment has turned for the better with ongoing United States and China meeting and talks to resolve trade war tensions and vowed not to raised additional tariffs targetting at each other and enter a truce of 90 days since the G20 meeting in 30 November 2018 hosted by Argentina.

Recently, China has " took more steps to defuse trade tensions with the U.S., confirming it will remove the retaliatory duty on automobiles imported from America and preparing to restart purchases of American corn" and "China also may buy at least 3 million metric tons of American corn" reported by Bloomberg in 14 December 2018.

https://www.bloomberg.com/news/articles/2018-12-14/china-cuts-tax-on-u-s-vehicles-in-move-to-soothe-trade-tensions

https://www.ttnews.com/articles/trade-war-drives-farmers-corn-china-shuns-us-soybeans

https://www.reuters.com/article/us-usa-trade-china-soybeans/china-poised-to-buy-more-u-s-soybeans-sources-idUSKCN1OJ2O1

https://www.chicagotribune.com/business/ct-farmers-trade-war-aid-checks-20180923-story.html

An article "A Tale of Two Commodities: China’s Trade in Corn and Soybeans' by Fred Gale Economic Research Service, USDA quote "Since the 1990s, the conventional wisdom was that China‘s growing demand for corn to feed an expanding livestock herd would lead to rising Chinese imports, boosting grain prices and incomes for U.S. farmers eager to find new sources of demand. However, China‘s growing 0 20 40 60 80 100 120 140 160 2001 2002 2003 2004 2005 Yuan/mu Corn Soybeans Source: National Development and Reform Commission Note: 15 mu = 1 hectare; 8.28 yuan = $1 0 5,000 10,000 15,000 20,000 25,000 30,000 1992 1994 1996 1998 2000 2002 2004 2006 1,000 HA Corn Soybeans Source: China National Bureau of Statistics Gale Chap.3: A Tale of Two Commodities 79 China's Agricultural Trade: Issues and Prospects demand emerged in the form of soybean imports that grew beyond most forecasters‘ expectations. China‘s corn imports have not yet materialized."

https://ageconsearch.umn.edu/bitstream/55021/2/Gale%20Chapter%203.pdf

China need massive imports of Corn to feed its livestock (Pigs) and Chinese one of the main food source staple is stem from Soybeans where it is made into beancurd (Tofu), soy milk, soy flour and soy protein. Soybeans are processed for their oil & protein for animal feeding industry and used for non food industrial products.

http://ncsoy.org/media-resources/uses-of-soybeans/

Wyatt Mingji Lim, Co-Founder at DefensePoliticsAsia.com (2017-present) in quora quote "while as recent as 1995, China was producing 14 million tons of soy beans and consuming 14 million tons - the number ballooned to 70 million tons in 2011.

So if China were to produce all 70 million tons of soy bean they need, it will mean that they need to convert 1/3 of the grain land to soybean - forcing China to import 160 million tons of grain (which is also more than 1/3 of the total grain consumption in China in 2011).

So, yes China is big, but arable land, there is only so much. China have a massive population to feed, thus, converting land for grain, to soy bean - is extremely impractical, not to mention, impossible.

Lets take a look at the Technical Chart below deciphering price action setup.

Teucrium Soybeam ETF Monthly Histoical Chart 30.1.19

Teucrium Soybeans Monthly Histoical Chart With Technical Analysis 30.1.19

Based on above Technical Anlsysis, Teucrium Soybean Fund ETF all time high is 28.88 seen in June 2012. Fair Value works out to be 14.44 and undervalue price works out to be 7.22. Chart display clearly a bullish price action setup with certain indicators like 20 Day Simple Moving Average (SMA) seen candlestick close above. Price in seen moving in a price channel comprising upper and lower orange color lines and green color median line. Potential big rounding bottom chart formation signals bullish market sentiment is on the cards where the recent trade war tariffs has seen price bottoming out at 15.26 low in September 2018 and price rebound to last close trading price at 16.65. My target for Teucrium Soybean ETF are lised below:

1) 1st Target resistance is between 20.50

2) 2nd Target resistance is 22

3) 3rd Target resistance is 25.25

4) 4th Target resistance is 28.88

5) 5th Target resisstance is 44

http://teucriumsoybfund.com/

Finviz Soybean Monthly Historical Chart 30.1.19

Finviz Soybean Monthly Historical Chart With Technical Analysis 30.1.19

Above Finviz Soybean Technical Analysis Chart display bullish price action setup. It has a potential rounding bottom chart formation couple with falling wedge chart formation illustrated drawn in black color lines. Price has reached support and supported by light blue color classical neckline that connects all the trough and resistance couple with falling wedge black color line support and orange color line rounding bottom support. Price may see resisted and backtest resistance turn support approaching four orange color lines target resistance.

Soybean Historical Chart 30.1.19 source from Barchart

Soybean Historical Chart 30.1.19 with Technical Analysis source from Barchart

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Recently there is a negative new that cause bearish, gloom and doom sentiment that hit commodity soybean pretty much is the Trade War Tensions between United States and China in year 2018.

To counter or retailate US trade war additional tariffs imposed on China, China asked its farmers to grow more soybeans amid trade fights with US.

https://www.npr.org/2018/06/19/621448109/china-tells-farmers-to-grow-more-soybeans-amid-trade-fight-with-u-s

Soybean - Teucrium Soybean Fund ETF has seen price bottoming at price level 15.26 in September 2018 where Trade Tensions ran high with each United States and China both imposing an additional trade tariffs targetting at each other.

However, currently market sentiment has turned for the better with ongoing United States and China meeting and talks to resolve trade war tensions and vowed not to raised additional tariffs targetting at each other and enter a truce of 90 days since the G20 meeting in 30 November 2018 hosted by Argentina.

Recently, China has " took more steps to defuse trade tensions with the U.S., confirming it will remove the retaliatory duty on automobiles imported from America and preparing to restart purchases of American corn" and "China also may buy at least 3 million metric tons of American corn" reported by Bloomberg in 14 December 2018.

https://www.bloomberg.com/news/articles/2018-12-14/china-cuts-tax-on-u-s-vehicles-in-move-to-soothe-trade-tensions

https://www.ttnews.com/articles/trade-war-drives-farmers-corn-china-shuns-us-soybeans

https://www.reuters.com/article/us-usa-trade-china-soybeans/china-poised-to-buy-more-u-s-soybeans-sources-idUSKCN1OJ2O1

https://www.chicagotribune.com/business/ct-farmers-trade-war-aid-checks-20180923-story.html

An article "A Tale of Two Commodities: China’s Trade in Corn and Soybeans' by Fred Gale Economic Research Service, USDA quote "Since the 1990s, the conventional wisdom was that China‘s growing demand for corn to feed an expanding livestock herd would lead to rising Chinese imports, boosting grain prices and incomes for U.S. farmers eager to find new sources of demand. However, China‘s growing 0 20 40 60 80 100 120 140 160 2001 2002 2003 2004 2005 Yuan/mu Corn Soybeans Source: National Development and Reform Commission Note: 15 mu = 1 hectare; 8.28 yuan = $1 0 5,000 10,000 15,000 20,000 25,000 30,000 1992 1994 1996 1998 2000 2002 2004 2006 1,000 HA Corn Soybeans Source: China National Bureau of Statistics Gale Chap.3: A Tale of Two Commodities 79 China's Agricultural Trade: Issues and Prospects demand emerged in the form of soybean imports that grew beyond most forecasters‘ expectations. China‘s corn imports have not yet materialized."

https://ageconsearch.umn.edu/bitstream/55021/2/Gale%20Chapter%203.pdf

China need massive imports of Corn to feed its livestock (Pigs) and Chinese one of the main food source staple is stem from Soybeans where it is made into beancurd (Tofu), soy milk, soy flour and soy protein. Soybeans are processed for their oil & protein for animal feeding industry and used for non food industrial products.

http://ncsoy.org/media-resources/uses-of-soybeans/

Wyatt Mingji Lim, Co-Founder at DefensePoliticsAsia.com (2017-present) in quora quote "while as recent as 1995, China was producing 14 million tons of soy beans and consuming 14 million tons - the number ballooned to 70 million tons in 2011.

So if China were to produce all 70 million tons of soy bean they need, it will mean that they need to convert 1/3 of the grain land to soybean - forcing China to import 160 million tons of grain (which is also more than 1/3 of the total grain consumption in China in 2011).

So, yes China is big, but arable land, there is only so much. China have a massive population to feed, thus, converting land for grain, to soy bean - is extremely impractical, not to mention, impossible.

And just in case you want to say, “我们可以不吃豆!(we can don’t eat bean)” - a lot of the soy bean is not for you, its for your pigs"

https://www.quora.com/Why-does-China-import-soybeans-from-the-US

https://www.fastcompany.com/90240606/chinas-hunger-for-soybeans-is-a-window-into-an-encroaching-environmental-crisis

http://www.earth-policy.org/books/fpep/fpepch9

Commodity Soybean indeed is a buying opportunity should the trade war tension ease and resolve couple with the weakening US dollar could see commodity corn priced in US dollar price rally to new highs.Lets take a look at the Technical Chart below deciphering price action setup.

Teucrium Soybeam ETF Monthly Histoical Chart 30.1.19

Teucrium Soybeans Monthly Histoical Chart With Technical Analysis 30.1.19

Based on above Technical Anlsysis, Teucrium Soybean Fund ETF all time high is 28.88 seen in June 2012. Fair Value works out to be 14.44 and undervalue price works out to be 7.22. Chart display clearly a bullish price action setup with certain indicators like 20 Day Simple Moving Average (SMA) seen candlestick close above. Price in seen moving in a price channel comprising upper and lower orange color lines and green color median line. Potential big rounding bottom chart formation signals bullish market sentiment is on the cards where the recent trade war tariffs has seen price bottoming out at 15.26 low in September 2018 and price rebound to last close trading price at 16.65. My target for Teucrium Soybean ETF are lised below:

1) 1st Target resistance is between 20.50

2) 2nd Target resistance is 22

3) 3rd Target resistance is 25.25

4) 4th Target resistance is 28.88

5) 5th Target resisstance is 44

http://teucriumsoybfund.com/

Finviz Soybean Monthly Historical Chart 30.1.19

Finviz Soybean Monthly Historical Chart With Technical Analysis 30.1.19

Above Finviz Soybean Technical Analysis Chart display bullish price action setup. It has a potential rounding bottom chart formation couple with falling wedge chart formation illustrated drawn in black color lines. Price has reached support and supported by light blue color classical neckline that connects all the trough and resistance couple with falling wedge black color line support and orange color line rounding bottom support. Price may see resisted and backtest resistance turn support approaching four orange color lines target resistance.

Soybean Historical Chart 30.1.19 source from Barchart

Soybean Historical Chart 30.1.19 with Technical Analysis source from Barchart

Disclaimer: All news, information and charts shared is purely by my research and personal views only. This is not a trading recommendation or advice but on the basis of sharing information and educating the investment community. Different traders and investors adopt different trading strategies and risk management approach hence if in doubt please approach or seek clarifications with your Financial Adviser, Broker and Banker.

Subscribe to:

Posts (Atom)